Let’s flash back a few years to a time where MY credit reports weren’t locked down. I’m not sure why I thought I was so invincible to any problems. Me with my perfect 850 score that I bragged about for the full 37 straight months I had it. Even though my credit reports weren’t locked down, I was still quite credit obsessed. I happily signed up for all the free services that would alert me to changes to my credit report – just because I could.

These services are mostly annoying. “You paid off your credit card!” Yes, I know. I manage my finances and I know what’s going on. Every once in a while there was something slightly more interesting, but nothing I was unaware of. Until…

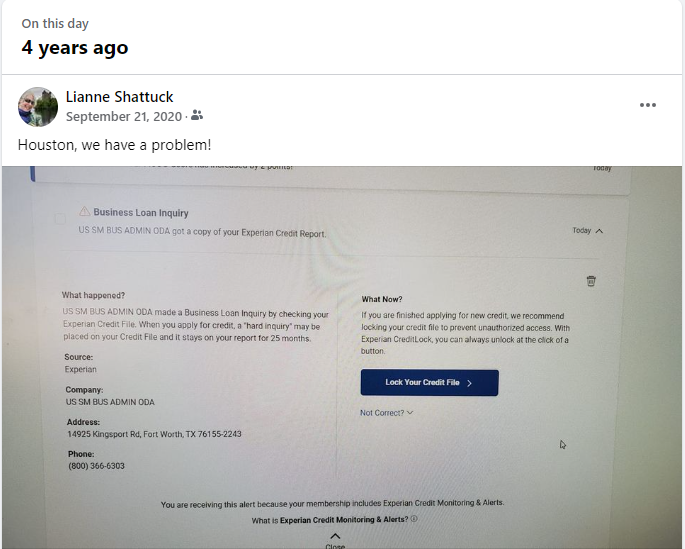

Imagine my surprise – when I was just sitting at the office, working as usual – and a strange email came across my phone. The email was from one of the free services I had signed up for, alerting me to the inquiry on my credit report.

Uh – WHAT? I hadn’t applied for any new credit.

Well, well… apparently someone was under the impression that I had applied for a business loan from the Small Business Administration. I immediately picked up the phone and called Experian to dispute this. The woman on the phone was beyond helpful – squashing the inquiry, putting out a fraud alert, and advising me to immediately call the SBA and stop the application.

The woman that answered the phone at the SBA was just as helpful. The application had come through just a few a minutes prior and hadn’t been funded yet. She verified that my email address, phone number, and maybe a couple of other items were quite different from the ones on the application. The funding request was to go to one of those untraceable prepaid accounts. The rep immediately canceled the funding request, but warned me that someone could simply put through another request. That’s when I started doing some research…

I didn’t immediately understand how LUCKY I was, but I quickly came to realize that. At the time, in the height of the pandemic, many people were getting hit with fraudulent items such as this. In my job, I saw countless numbers of fraudulent unemployment claims. I started hearing about other types of fraud as well, but no one I knew got hit with a SBA loan request like I did. It was downright scary the more I learned about this stuff.

Back in 2020, the folks that were unfortunate enough to have a fraudulent Small Business Administration loan taken out in their name, were not necessarily as fortunate as I was in this situation. I quickly learned that the SBA didn’t care WHO took the loan out, they just wanted their money back. TERRIFYING! I can’t imagine what folks had to go through to eventually get their record cleaned up. I have since learned that the fraud CAN be cleared up, it just takes some time. It’s fixable, but there was a time where people were being held responsible for those fraudulent loans. That alone scared the hell out of me! I warned everyone I could. Did they listen? I have no idea.

So even though I didn’t have my credit reports locked down *at that time*, all those services I was signed up for saved my butt!!! I was able to get this loan request shut down within 10-15 minutes of the request being initiated. All because of a free alert that came through my email.

You can be sure that my reports were locked down that day! This experience freaked me out enough that I didn’t even touch my credit for at least a couple of years. I couldn’t be bothered to unlock my credit reports, even for a few hours. Wasn’t worth the risk.

I have learned how to work with the temporary unlocks. Now I educate folks every chance I get: LOCK YOUR REPORTS! Your information is out there on the web, like it or not. Everyone’s information is. No one is immune to this stuff. The only reason I was alerted, was because of the free services I signed up for.

If you aren’t signed up for such services*, and your reports aren’t locked down – what could even be on there that you aren’t aware of? That alone should scare you enough to do something. TAKE ACTION TODAY!

*Services include: Credit Karma, Credit Sesame, Experian, Equifax, and Transunion – among other services out there. These are just a few examples.